Inflation and Recession in India (Explained)

The inspiration for this blog post was this tweet:

Even though we come across ‘inflation’ and ‘recession’ a thousand times around the news and internet, we still stumble in explaining what exactly causes these two ubiquitous macroeconomic phenomena.

What is inflation?

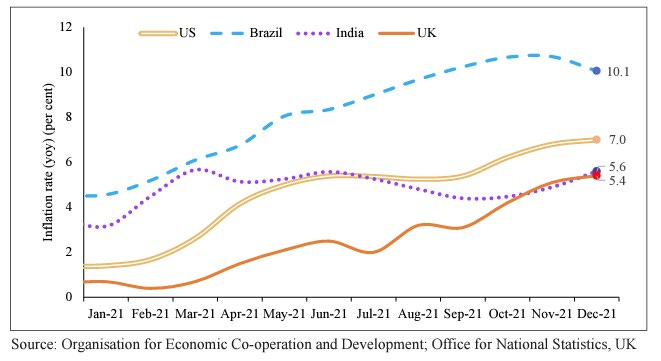

Inflation is a persistent and continuous rise in the general price level of an economy. As of now, the inflation rate is around 7%, the highest it has been since October 2020. The standard benchmark against inflation is the CPI (Consumer’s Price Index). CPI shows the price of a typical basket of goods, consumed in an economy. If CPI rises considerably, we say inflation is here.

Inflation in India

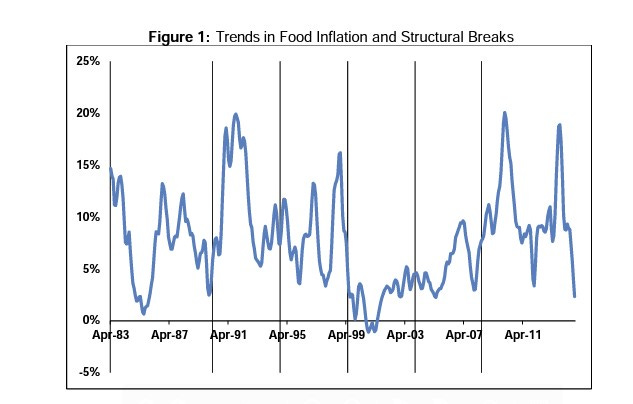

One of the significant causes of inflation in India has been food price inflation. A rise in export as well as internal demand, or supply shocks like rising oil prices and a rise in rural wages, have caused a surge in prices of consumables in the past.

As boldened above, the source of inflation itself can be seen from the demand or supply side. If the excess demand for commodities causes the prices to increase then it’s demand-pull inflation.

If a rise in the cost of production forces producers to hike up the commodity prices then it’s cost-push inflation.

Jain (2015) posits that food inflation in India is mainly due to cost-push factors like agricultural bottlenecks and demand side factors are propagating factors, not causal ones.

Disruptions in global supply chains, rise in input and transportation costs and pent-up consumer demand can all be factors causing global inflation right now, post-pandemic.

What is a Recession?

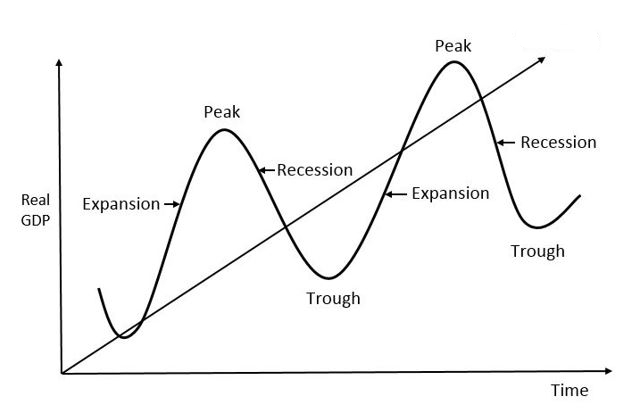

In most beginner economics classes, we are introduced to a simple diagram that shows how the real GDP of an economy increases with time, not in a linear but in a cyclical fashion.

Recessions are declines in economic activity, that are characterized by high unemployment and less aggregate demand.

Political turmoils such as the Russian-Ukraine war, global supply breakdowns such as the Pandemic, or a crumbling down of the financial systems a la 2008 US housing bubble burst are all causes of economic recessions.

A falling GDP growth rate and an increasing unemployment rate is the most popular benchmark for recession. In theory, falling product prices are also a sign of recession but that’s not the case now. Inflation as well as unemployment is present in most economies, a departure from the original Phillips curve, leading us to a limbo called stagflation.

Monthly Economic Review (MER) 2022, noted that India may have low risks of stagflation but it still has to stride through the challenges of low growth and inflation effectively to get back on its two feet post-pandemic.